Funding A Buy-Sell Agreement With Life Insurance

The most important business contingency plan you are putting off...

Get Online Term Life Insurance Quotes With Major Carriers Now!

We believe that you will be pleasantly surprised as to how inexpensive it is to protect your mortgage, your family and loved ones. GET INSTANT QUOTES with many top rated life insurance carriers in the United States and then apply directly online.

Income Replacement

Life insurance can replace many years of lost income for your family if you dearly depart this world prematurely!

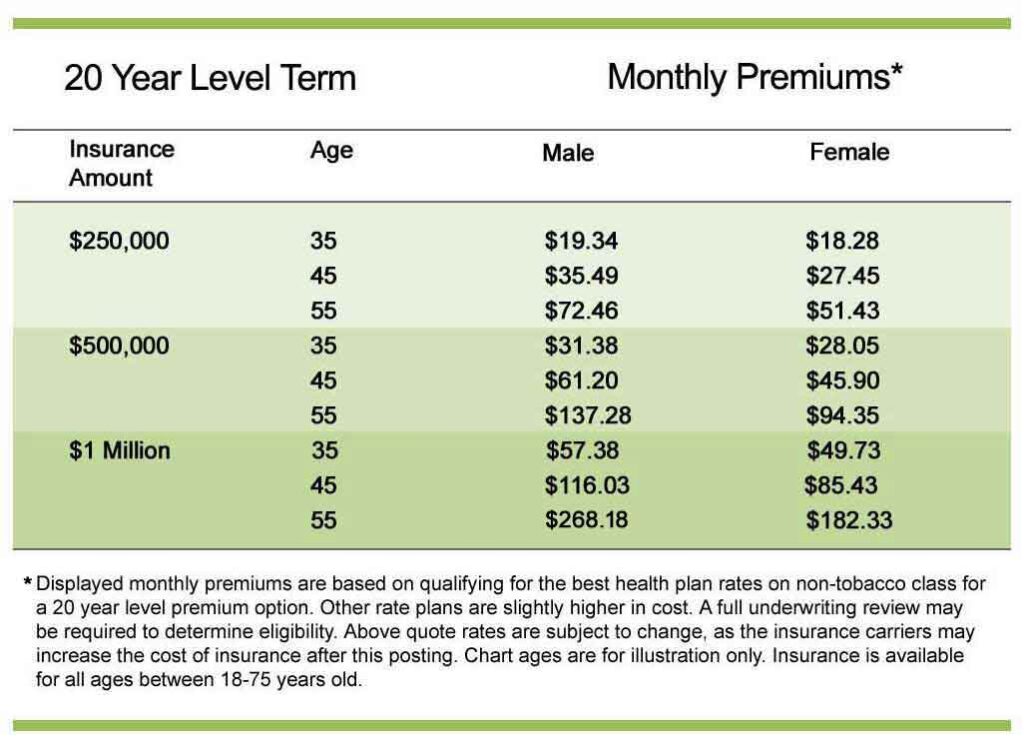

Look At How CHEAP Term Life Insurance Can Be

Video How To Get Instant Quote And Apply

Breadwinner…

Term Life Insurance can help replace your lost income so your family can continue to pay for everyday expenses and live the lifestyle they are used to. Term Life Insurance can cover working years lost income of insured.

Someone who wants to provide an inheritance…

If you don't have a lot of wealth, life insurance can provide an inheritance to heirs. Level Term Life Insurance will pay money for the inheritance as long as the policy is in force at the time of death.

Homeowners with a mortgage…

A Term Life Insurance policy can cover mortgage payments, so your family doesn’t have to move. A level Term Life Insurance can match or exceed the years of a mortgage.

LIFE INSURANCE QUOTER AND APPLY MADE EASY FOR YOU HERE!

Term Life Insurance is probably much cheaper than you ever thought. Take a few minutes now and get a quote yourself and then start the process for financially protecting your family in case of your departure from life.

This website will check with the major life insurance carriers to get the best rate for your individual situation. Applying online is fast and easy.

What would happen to your family if you were to die prematurely? Would they be able to maintain their current lifestyle?

Would your children be able to go to college?

Would your spouse be able to carry the load and pay all the bills with only one income?

If you have a child, are married, or you are carrying any kind of debt, purchasing life insurance is a no-brainer.

If all three, well, then hopefully, for you and your family’s sake, you should not hesitate a moment longer. The time to act is NOW!

Here are a few other reasons to have life insurance though:

- charitable donations

- pay federal death and estate taxes

- create an inheritance for your heirs

- pay final expenses

What would happen to your family if you were to die prematurely? Would they be able to maintain their current lifestyle?

Our Mission Statement

GET QUOTE NOW AND APPLY ONLINE!

Get Covered Now With Life Insurance

Check now how inexpensive it is to protect your family and loved ones. More than likely if you are married and the breadwinner in the family, if you told your spouse that you are going to get life insurance “just in case something unexpected happens to me”, and to show her / him that hypothetically speaking, that she / he may be financially destitute if you were “gone”. We think you both would agree that if the monthly price made sense that you would get coverage as soon as possible…..

…… Take a few minutes now, and we believe that you will be pleasantly surprised as to how inexpensive term life insurance can be.