What Is Term Life Insurance

What is Term Life Insurance?

Term life insurance is typically the most affordable option to protect your family in the event that something happens to you. It’s a policy that covers you for a specific amount of time, or term — typically 10, 15, 20 or 30 years. You make premium payments during the term you’ve selected, and your insurer will pay a death benefit to your beneficiaries if you pass away.

Why term life insurance?

Term life insurance tends to be a more affordable policy than permanent life insurance because it doesn’t build any cash value that you can borrow against or invest, and it ends at the term of your contract instead of providing lifetime coverage. If you still need coverage at the end of your term, however, you may be able to renew or convert your policy to a permanent life insurance policy.

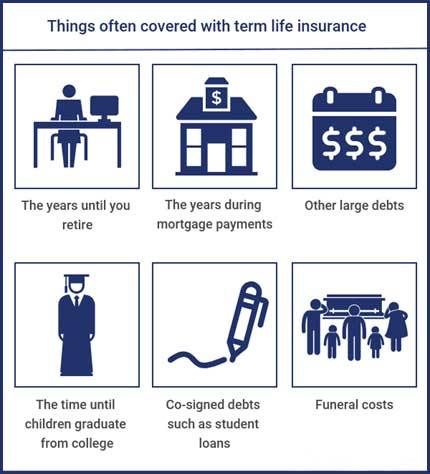

Select the duration of your coverage. Decide the number of years your financial needs will be greatest (for example, when your kids are younger or while you are paying a mortgage)